Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. Labor Department reported a big drop on jobless claims, by 22,000 files, refreshed the biggest decrease from November 20th. House sales in April down 3.4% on the year.

Iron Ore Key Indicators:

• Platts62 $110.30, -0.70, MTD $106.75. Chinese ports maintained active trades. COREX traded 90kt Fe60.5% JMBF at AM62% June INDEX -$4.2. MACF saw a fixed trade. There were many ongoing interests, expected to last through at least current 1-2 week.

SGX Iron Ore 62% Futures& Options Open Interest (May 18th)

• Futures 92,606,300 tons(Increase 199,700 tons)

• Options 111,125,300 tons(Increase 1,213,400 tons)

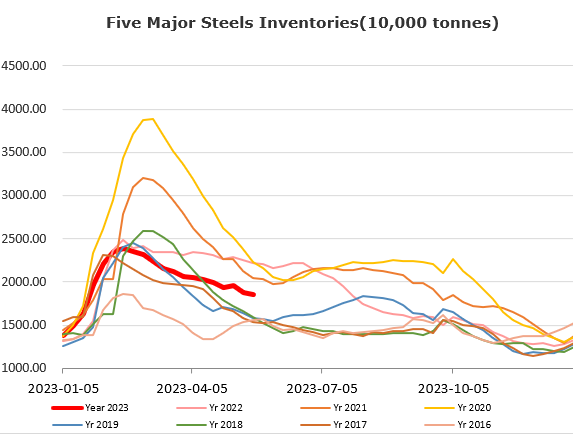

Steel Key Indicators:

• MySteel surveyed sample EAFs average cost 3874 yuan/ton, up 3 yuan/ton. Average loss at 102 yuan/ton, down 38 yuan/ton on the week.

Coal Indicators:

• The FOB Australia coking slumped during the current week because of the crowded supply. For June laycans, HCCA Branded bid at $198/mt similar to yesterday.

• Major steel mills in Hebei, Shandong from China started the eighth rounds of coke decrease by 50 yuan/ton.