Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. Markit May PMI 48.5, less than expected 50, refreshed the lowest of last three months. Eurozone PMI May at 44.6, last 45.8.

• The third round of U.S. Debt ceiling negotiations between the White House and Congressional leadership continued with no resolution, although both sides described that the meeting was “productive”.

Iron Ore Key Indicators:

• Platts62 $102.40, -2.45, MTD $106.46. Term contracts discount widened. JMBF discount increased from 3% to 4.25% based on IODEX June index. MACF was unchanged. Seabonre iron ore inquiries disappeared as the U.S. debt risk crushed down the risk appetite of assets. Moreover, the negative import margin create pressure to buy seaborne. However, the Tangshan supply of high grade concentrates were tight in May and June. Thus, seaborne interests expected to maintain in a continual mode during the current weeks instead of vanishing.

SGX Iron Ore 62% Futures& Options Open Interest (May 23rd)

• Futures 97,353,300 tons(Increase 2,514,000 tons)

• Options 112,905,300 tons(Increase 400,000 tons)

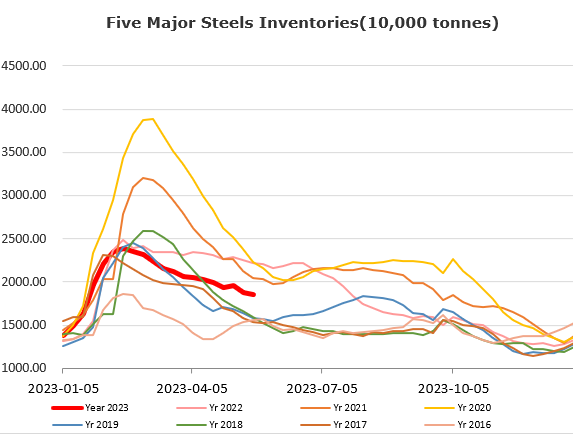

Steel Key Indicators:

• World Steel Association statistic indicated that global crude steel production down 2.4% to 161.4 million tons. Jan-Apr global steel production down 0.3% to 622.7 million tons.

Coal Indicators:

• Australia coking coal demand slipped during this week. A 75,000mt of globalCOAL HCCA Branded was bidding at $194/mt, while a 35,000mt of globalCOAL HCCLV was bidding at $189/mt.