Market Verdict on Iron Ore:

• Neutral.

Macro:

• The number of unemployment benefits files in U.S. last week reached 229,000, a new low since the week of April 22, 2023, with an estimated 245,000 files, compared to the previous value of 242,000 files.

• Chinese completed new issued local bonds exceeded 2 trillion yuan, and nearly 80% of the pre-approved quota. Analysts said that the progress of bond issuance will be further accelerated, and expected that the annual issuance target of 3.8 trillion yuan will be completed in the third quarter of 2023.

Iron Ore Key Indicators:

• Platts62 $98.10, +0.75, MTD $105.49. Import margin improved fast during the last few days, inducing significant buying interest yesterday on seabornes trading window. There was a PBF bid for June laycan at $1.85/dmt based on June Index, however sellers wanted to hold to see competitors. BRBF was sold by Vale at a premium of $3 based on July Index. There were still very limited trading activities in Chinese port areas.

SGX Iron Ore 62% Futures& Options Open Interest (May 25th)

• Futures 101,370,500 tons(Increase 1,083,100 tons)

• Options 113,282,300 tons(Increase 195,000 tons)

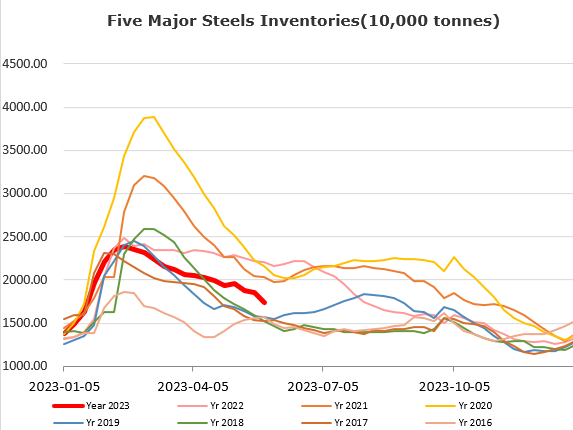

Steel Key Indicators:

• MySteel sample EAFs average cost at 3834 yuan/ton, down 40 yuan/ton on the week. Average loss at 137 yuan/ton.

Coal Indicators:

• China physical coke started the ninth rounds of decrease by 50 yuan/ton, total nine rounds cut 800 yuan/ton.