Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. CPI annual rate up 4% in May, created an 11 month drop in a roll, refreshed new low since March 2021, est. 4.1%, last 4.9%. The market expected that the U.S. Federal would skip interest hike in June.

• China central bank PBOC lowered 10 bps for 7-day repo to 1.9%, refreshed historical low. China May social financing increased by 1.56 trillion yuan, up 331.2 billion yuan on the month, 1.31 trillion yuan lower than last year. M2 supply up 11.6%, down 0.8% on the month.

Iron Ore Key Indicators:

• Platts62 $112.90, +0.50, MTD $111.35. Several steel mills in Qinhuangdao, China suspended the sintered facilities because of the new round of pollution weather. The seaborne market suddenly muted eying the correction in derivatives market. The changing hands in secondary market disappeared. In primary market, both discount of MACF and JMBF raised because of increasing supply in June and July. BHP sold JMBF based on July IODEX at discount of $4.2.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 13th)

• Futures 96,143,100 tons(Increase 1,209,200 tons)

• Options 105,903,100 tons(Increase 1,469,000 tons)

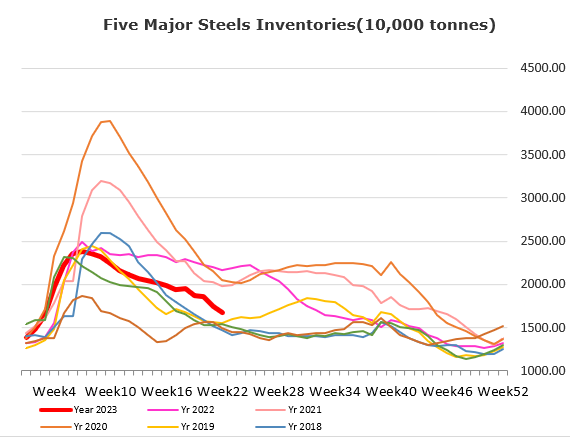

Steel Key Indicators:

• U.S. HRC prices fell to $880 on ex-work basis, a 27% decrease since the high in April. Service centers are only completing back-to-back deals for their clients.

Coal Indicators:

• The CFR China was still lower than FOB Australia coking coal, indicating a lackluster demand from China. There was a 35,000mt bid on Peak Downs PLV at $195/mt. India buyers indicated that the U.S./Canada origin became competitive to Australia market.