Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. lowered the unemployment rate expectation to 4.1%, est. 4.5%. U.S. PPI in May up 1.1%, refreshed new low since December 2020, est. 1.5%, last 2.3%. PPI down 0.3% on the month, est. down 0.1%, last increase 0.2%.

• U.S. FOMC announced to maintain unchanged in the interest rate in June, however expected a 25 bps increase in the rest of 2023.

• China NBS: National house development investment at 4.57 trillion yuan, down 7.2% for the first months in 2023. Commercial house sales at 4.64 trillion square meters, down 0.9% on the year.

Iron Ore Key Indicators:

• Platts62 $114.30, +1.40, MTD $111.68. Seaborne market became slight quiet in PBF, as an offer at July Index + $2.6 failed to attract buying interest. MACF saw changing hands at July Index and $1.88 discount. The ports of China regained popularity because of the import loss on iron ore.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 14th)

• Futures 97,093,200 tons(Increase 950,100 tons)

• Options 106,818,100 tons(Increase 915,000 tons)

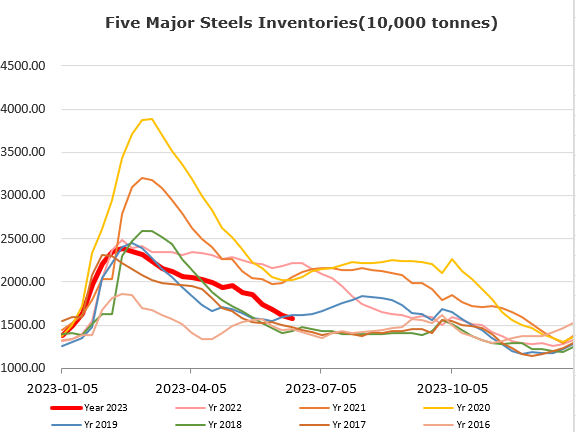

Steel Key Indicators:

• China NBS: China crude steel production at 90.12 million tons in May, down 7.3% on the year. Total production of crude steel reached 444.63 million tons for the first five months in 2023 in China, up 1.6%.

Coal Indicators:

• An European steelmaker bought 75,000mt PLV German Creek at $219.5.

• The Indian mills were actively sourcing June and July coking coals.