Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. PMI in June at 53.0, refreshed three month low, however maintained above 50 for five consecutive months.

Iron Ore Key Indicators:

• Platts62 $112.15, -0.25, MTD $112.68. Some Chinese sintered facilities suspension, following with macro change including U.S. interest hike and Chinese LPR decrease was smaller than expectation, iron ore market saw a correction after a two-week fast rebound. Seaborne market and port market saw light trade because of Chinese dragon boat festival.

• According to Brazil Sinferbase statistics, Vale exported 16.32 million tons of iron ores, up 4.2% on the year, down 11.7% from April. Jan- May total exported 69.9 million tons of iron ore, down 13.7% on the year.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 23rd)

• Futures 103,263,100 tons(Increase 130,200 tons)

• Options 114,949,600 tons(Increase 100,000 tons)

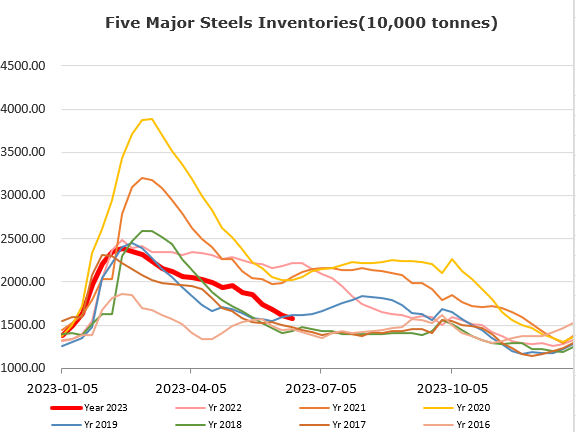

Steel Key Indicators:

• Turkey increased interest rate from 8.5% to 15%, which increased steel mills financing cost. Some domestic mills indicated that they potentially sell scrap at loss/zero profit to maintain liquidity.

Coal Indicators:

• The FOB Australia coking coal met with downward pressure as U.S./Canada sources became alternatives in seaborne market. CFR China was stable across Dragon Boat Festival.