Market Verdict on Iron Ore:

• Neutral.

Macro:

• The U.S. Markit Manufacturing PMI in June was 46.3, est. 46.3, last 48.4. Eurozone Manufacturing PMI 43.4, est. 43.6, last 43.6.

Iron Ore Key Indicators:

• Platts62 $110.55, -1.05, MTD $110.55. Tangshan restriction official carried out, limited trading activities observed on Chinese ports and slight decrease the price. Seaborne trades were active due to the support of import margin, as well as growing demand from high grade and low grade.

• From July 1st to July 31st, Tangshan Steel Company implemented environmental protection production restrictions. The production of grade A steel for sintering in the region is limited by 30%, and grade B and below steel is limited by 50%. Oil trucks are not allowed for transportation from 18:00 to 8:00 the next day. The sintering ore inventory estimated to have 20 useable days under production restrictions. As of now, four blast furnaces are scheduled to undergo maintenance in July, involving a production capacity of approximately 21,000 tons per day. There is a possibility of continuous increase in blast furnace maintenance in the region currently.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 3rd)

• Futures 90,524,400 tons(Increase 2,059,700 tons)

• Options 86,899,600 tons(Increase 165,000 tons)

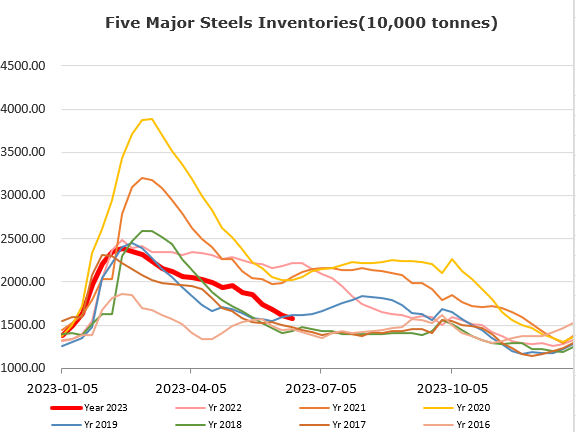

Steel Key Indicators:

• The biggest EAF Steelmaker in North America, Nucor kept its plate price flat at $1,570/st for the second consecutive month.

Coal Indicators:

• There was 75,000mt Peak Downs PLV offered at $230 late last week delivered in August, after same source of cargo traded at $234 last Fridya.

• Indian end users were considering alternative second Tier sources from U.S., Canada, Poland, or Ukraine.