Market Verdict on Iron Ore:

• Neutral.

Macro:

• JPM said that the China housing turmoil raised chance for lower down payment ratios. Previously, the huge debt default risk in Evergrande failed analysts expectations.

Iron Ore Key Indicators:

• Platts62 $115.85, +0.80, MTD $111.33. The seaborne trade refreshed the most active day of the year. Two MACF traded at $113.55 and $113.6 respectively. JMBF traded at August index – $4.4. BRBF sold at September Index + $3.8. Fe61% PBF traded at $113.6, Fe62% PBF traded at $115.6. There was secondary PBF traded at August Index + $2.1. However be aware of the fast narrow of virtual steel margin to a year-low, which could symbolise the sharp decrease on physical margin after 2-3 weeks.

• Vale iron ore production 78.74 million tons in Q2, up 17.9% q-o-q, up 6.3% y-o-y. Vale maintain annual production guidance unchanged at 310-320 million tons.

• Rio Tinto Pilbara produced 81.3 million tons, up 2% q-o-q, up 3% y-o-y. Rio Tinto maintained annual production target unchanged at 320 -325 million tons.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 18th)

• Futures 102,300,500 tons(Increase 1,838,500 tons)

• Options 103,000,800 tons(Increase 1,975,000 tons)

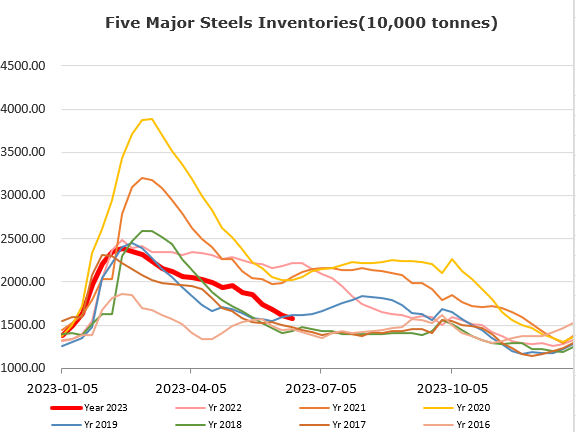

Steel Key Indicators:

• MySteel estimated July pig iron production at 74.46 million tons, up 1.256 million tons from June, up 5.736 million tons on the year.

Coal Indicators:

• China seaborne inquiries became active after the domestic price uptick, in particular for PHCC.