Market Verdict on Iron Ore:

• Neutral.

Macro:

• Bloomberg: major economists believed that the next interest rate increase would ended 16 months interest hike.

• Platts62 $116.25, +2.25, MTD $111.87. Seaborne market became quiet during the past two days. There was secondary trade on PBF at $1.1 based on August Index. Be aware of the fast narrow of virtual steel margin to a year-low, which could symbolise the sharp decrease on physical margin after 2-3 weeks.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 20th)

• Futures 103,735,300 tons(Increase 1,923,700 tons)

• Options 102,688,300 tons(Increase 910,000 tons)

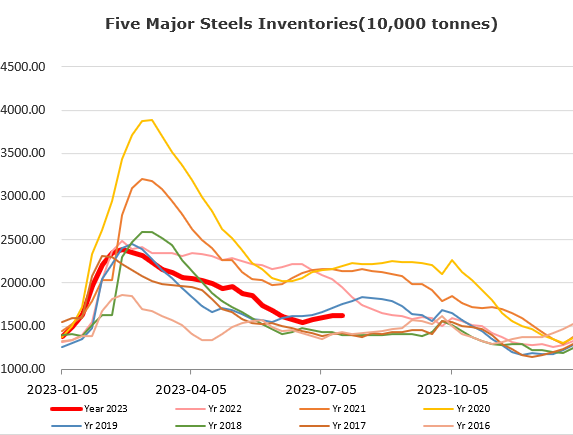

Steel Key Indicators:

• MySteel 247 sample steel mills blast utilisation rate at 83.6%, up 0.73% on the week, up 10.44% on the year. Daily pig iron production 2.44 million tons, down 1,100 tons on the week, up 240,300 tons on the year.

Coal Indicators:

• China seaborne inquiries became active and thus lifted CFR coking coal price significantly. Thus, FOB Australia also saw a rise in the week given Indian end-users wanted to lock price around $230. There was PMV Gooyella C traded at $237/mt yesterday for a full laycan.