Market Verdict on Iron Ore:

• Neutral.

Macro:

• China announced support for property construction by saying the government will boost the renovation of urban villages. It will also seek more private capital in the projects to expand domestic demand and push forward development of cities.

Iron Ore Key Indicators:

• Platts62 $115.35, -0.90, MTD $112.10. JMBF discount in August narrowed from 5% to 4.5%, MACF narrowed significantly from 2.75% to 0.25%. The fast drop on MACF discount was because some Chinese steel mills replace high premium PBF with MACF. In addition, Tangshan production cut provide support in lump demand.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 21st)

• Futures 105,522,000 tons(Increase 1,786,700 tons)

• Options 104,360,800tons(Increase 1,672,500 tons)

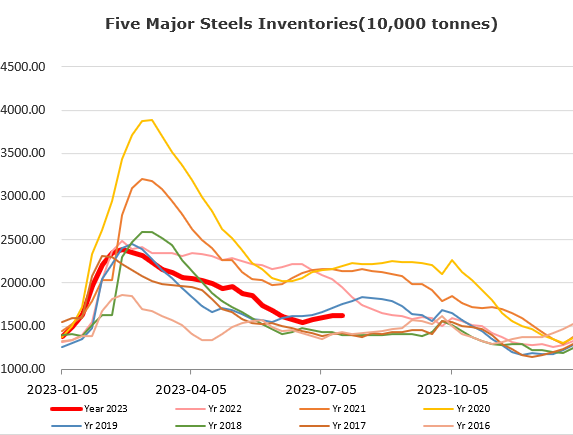

Steel Key Indicators:

• China steel mills imported iron ore total inventories at 84.02 million tons, down 1.1199 million tons on the week.

Coal Indicators:

• Indian demand start to decrease marginally post moonson season.

• Chinese domestic met coke price was proposed to increase 100- 110 yuan/ton by cokery plants. Indian domestic coke price slight decreased.