Market Verdict on Iron Ore:

• Neutral.

Macro:

• China vowed at a key economic policy meeting to optimize and adjust policies for

the property sector yesterday.

Iron Ore Key Indicators:

• Platts62 $114.50, -0.85, MTD $112.25. MACF saw active trades again yesterday, with a fixed trade at $112.1/dmt and a float price at $0.5 discount over August Index. There was a September PBF traded at $113.05, however fell out of Platts assessment window. There were Carajas and SSF traded in CNY. SSF was traded in CNY in H1 in most of circumstances.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 24th)

• Futures 107,740,600 tons(Increase 2,218,600 tons)

• Options 105,158,300 tons(Increase 797,500 tons)

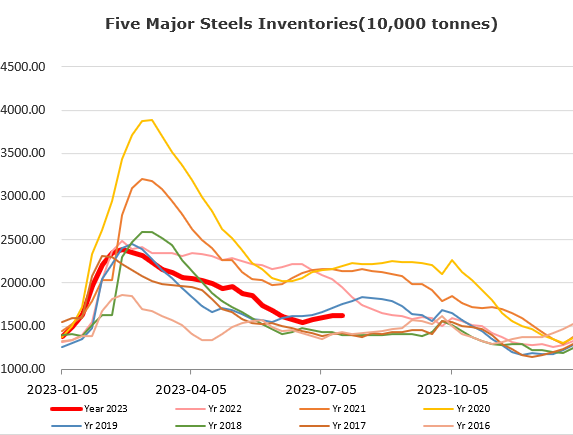

Steel Key Indicators:

• CISA: Member steel mills total produced 22.48 million tons of crude steels in mid-July, up 0.33% from early July.

Coal Indicators:

• Chinese domestic met coke price was proposed to increase 100- 110 yuan/ton by cokery plants. Indian domestic coke price slight decreased.

• Some coal mines in Shanxi and Inner Mongolia provinces ordered to halt operation because of the recent mining accidents.