Verdict:

• Short-run Neutral.

Macro:

• The ECB indicated that the Euro zone was in a high inflation mode and urged to bring inflation rate back to 2%.

• The Chinese government has laid out a work plan to maintain steady growth for its automotive industry during 2023-24, expecting a 3% sales growth in Automobile and 30% growth in NEV in 2023.

Iron Ore Key Indicators:

• Platts62 $118.50, +0.30, MTD $118.50. Brazil and Australia delivered 18.87 million tons of iron ore, up 709,000 tons on the week.

• MySteel indicated that Tangshan received a pollution curb notice, which would size down the sintered facilities by 20-30% through September.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 4th)

• Futures 129,812,000 tons(Increase 2,178,800 tons)

• Options 116,842,400 tons(Increase 1,407,500 tons)

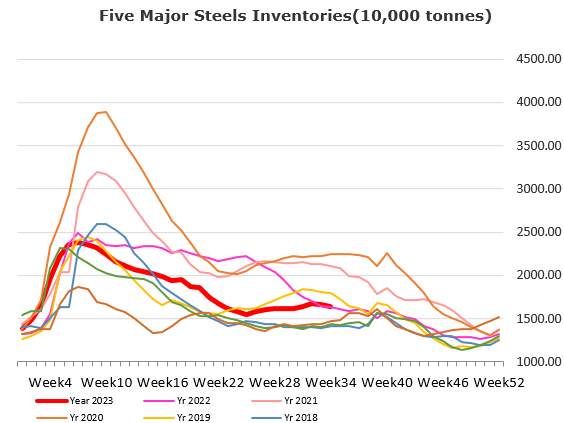

Steel Key Indicators:

• U.S. HRC corrected to $820-830/st, because the current strikes from three big auto-makers.

Coal Indicators:

• The FOB Australia market ticked up supported by resilient Asian demand. There was 50,000mt PMV Caval Ridge traded at $269.