Verdict:

• Short-run Neutral.

Macro:

• Saudi Arab and Russia extend the crude oil production curb. Saudi Arab would decrease 1 million barrels/day in the coming three months. Russia would decrease 300,000 barrels/day till the end of 2023.

• The US federal governor Christopher Waller saild the policymakers can afford to skip interest hike.

Iron Ore Key Indicators:

• Platts62 $118.75, +0.25, MTD $118.63. The growing high grade iron ore inventories and low inventories for mid-grade iron ore led to the narrowing of MB65- P62. The seaborne trades were light from last week and early this week because of limited supply.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 5th)

• Futures 110,535,700 tons(Increase 1,881,200 tons)

• Options 101,692,400 tons(Increase 1,891,200 tons)

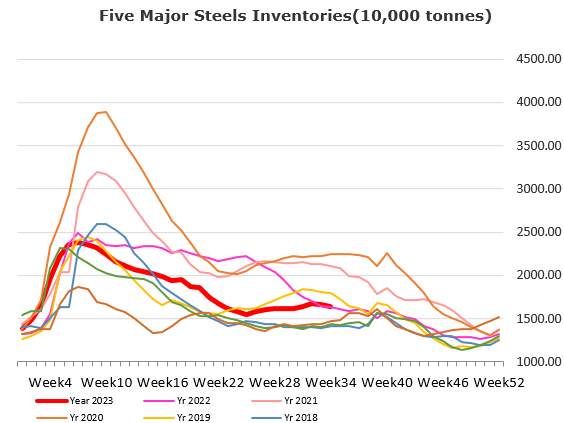

Steel Key Indicators:

• CISA statistic indicated that late August member steel mills produced 22.50 million tons, daily crude steel production at 2.0456 million tons, down 7.65% from mid-August.

• According to American Iron and Steel Institute, the utilisation rate of steels was 76%.

Coal Indicators:

• The FOB Australia market was supported by Indian end-users, in particular for PHCC. However Indian buyers indicated their interests on U.S. origin coals as alternatives.