Verdict:

• Short-run Neutral.

Macro:

• China engaged to initiate discussion with ASEAN countries in fields of NEVs and photovoltaics areas.

• The US Beige book indicated that the economy and job growth rates potentially slow down in July and August. Many enterprises expected a slow down on salaries growth.

Iron Ore Key Indicators:

• Platts62 $119.50, +0.75, MTD $118.92. The growing high grade iron ore inventories and low inventories for mid-grade iron ore led to the narrowing of MB65- P62. The seaborne trades were light from last week and early this week because of limited supply.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 6th)

• Futures 112,192,000 tons(Increase 1,656,300 tons)

• Options 103,881,900 tons(Increase 2,189,500 tons)

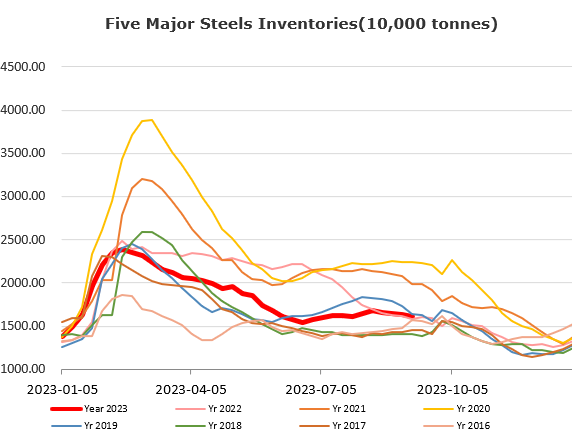

Steel Key Indicators:

• TS average billet cost 3547 yuan/ton, down 52 yuan/ton. Average production margin 23 yuan/ton, up 112 yuan/ton on the week.

Coal Indicators:

• The FOB Australia market was supported by Indian end-users, in particular for PHCC. The China coking coals gained support after the previous accidents triggered safety protocols.