Verdict:

• Short-run Neutral.

Macro:

• US Federal maintained interest rate from 5.25- 5.5% unchanged in the FOMC meeting in September, fell in the expectation of economists.

• UK inflation rate refreshed an 18-month low, which decreased expectations on further hikes.

Iron Ore Key Indicators:

• Platts62 $124.65, +1.90, MTD $121.42. JMBF discount widened from $2.2 earlier this week to $3 based on October AM62% index. There was JMBF traded at $2.7 discount yesterday. The slight weakened seaborne price indicated that the restock potentially become active in the coming few days.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 21st)

• Futures 136,521,700 tons(Increase 3,100,000 tons)

• Options 132,333,500 tons(Increase 3,745,000 tons)

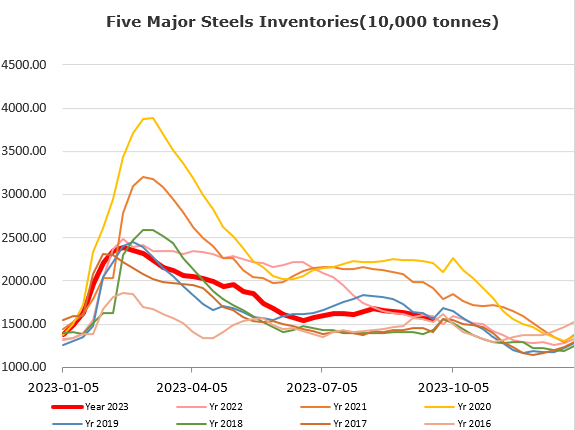

Steel Key Indicators:

• Tangshan average billet cost at 3562 yuan/ton, up 10 yuan/ton on the week, average profit at 8 yuan/ton, reversed the loss from past week.

Coal Indicators:

• China cokery plants coke price proposed to increase by 100-110 yuan/ton, accepted by most of steel mills.