Verdict:

• Short-run Neutral to Bearish.

Macro:

• ECB president Christian Lagarde indicated that the pre-historic high deposit rate could resist inflation to 2%, interest hike is still an option in rest of 2023.

• Evergrande Real Estate failed to settle principal and interest payments with the bond code”20 Hengda 04”, which should be settled in September 25th.

Iron Ore Key Indicators:

• Platts62 $118.80, -4.80, MTD $121.29. Some traders indicated that the SSF was almost sold out at China ports. Moreover, the negative steel margin lowered the demand for premium cargoes including NHGF and PBF. Stocking for China holidays in next week approached an end. The pig iron consumption expected to decrease in late September.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 25th)

• Futures 141,096,700 tons(Increase 267,600 tons)

• Options 135,504,100 tons(Increase 916,500 tons)

Steel Key Indicators:

• One of the biggest steel producer in China, Jiangsu Province produced 10.6525 million tons of crude steels, a decrease of 628,300 tons compared to the previous month. Mysteel predicts that the crude steel production in the province is expected to drop to below 9.5 million tons in September, but the produciton reduction requirements of “flat control” in the fourth quarter is still significant.

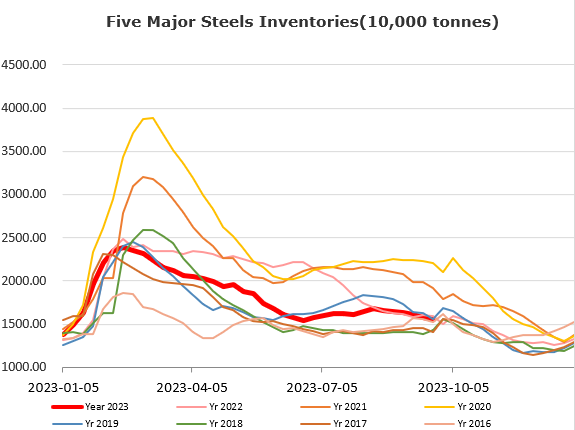

• According to data from CISA, in mid September 2023, the daily production of crude steel by member steel enterprises reached 2.1335 million tons, a decrease of 1.17% month on month and 0.54% decrease compared to the same period last year. The inventory of steel is 15.7568 million tons, a decrease of 0.92% compared to the previous ten days and a decrease of 5.25% compared to the same ten days last month.

Coal Indicators:

• The new HCCA bid at $327 for 75,000mt supported the FOB coking coal rebound slightly.