Verdict:

• Short-run Neutral.

Macro:

• China sovereign wealth fund increased its stake for the four biggest national banks for the first time since 2015, fueling hopes of rescuing investment market.

• Federal Reserve policymakers agreed last month that policy should remain restrictive for further months, noting the risks of overtightening.

Iron Ore Key Indicators:

• Platts62 $116.25, +2.20, MTD $118.13. NHGF and MACF China steel mills margin were concluded at $116.8/mt and $115.2/mt respectively yesterday. The market rummoured that the 7-months long-term PBF was concluded. Some mills started to sell PBFs and PBLs. Seaborne market regain popularity as the narrow of import margin.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 11th)

• Futures 120,297,100 tons(Increase 1,142,900 tons)

• Options 111,574,700 tons(Increase 1,773,500 tons)

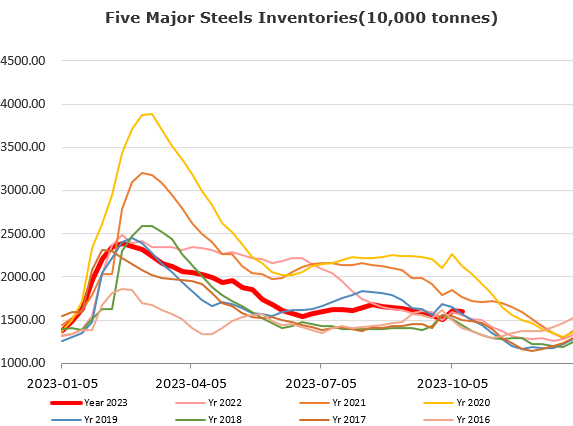

Steel Key Indicators:

• Tangshan average billet cost 3699 yuan/ton, up 26 yuan on the week. The average production loss for steel reached 279 yuan/ton.

Coal Indicators:

• The spread between end-user and traders were widen in Australia FOB market. Indian buyers were trying to negotiate based on a price level lower than Index, while sellers were looking at much higher level. There were market participants believed that as the increasing supply in November for prime coals, the price potentially see resistance for November delivery in next few weeks.