Verdict:

• Short-run Neutral.

Macro:

• China credit growth held steady in September with rapid government bond issuance to fund infrastructure sector, while strong mortgage lending statistics offsetting the decreasing new bank loans. M2 increased 10.3% in September on the year, last 10.6%, est. 10.6%.

Iron Ore Key Indicators:

• Platts62 $118.45, +0.25, MTD $118.17. The PBF and SSF spread narrowed significantly during the past five weeks from 150 yuan/ton to 85 yuan/ton, due to the fast narrowing steel margin in China, which supported the low grade demand. At the same time, the SSF stocks decreased significantly during the past three months. Traders were seeking for alternatives as SP10 and Indian fines, with amply available cargoes for prompt laycans.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 13th)

• Futures 122,973,800 tons(Increase 757,300 tons)

• Options 113,990,800 tons(Increase 311,400 tons)

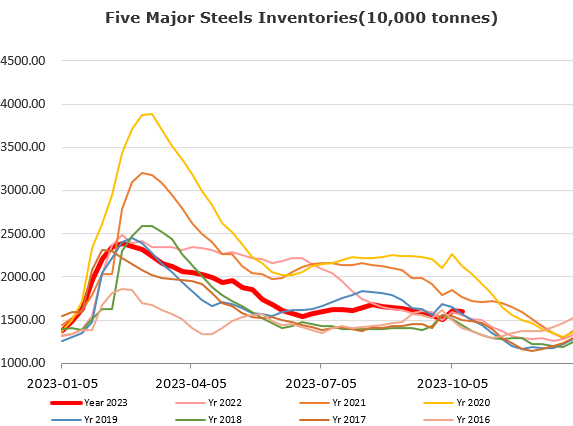

Steel Key Indicators:

• CISA statistic indicated that the member steel mills total produced 20.83 million tons of crude steel in late October, or 2.083 million tons per day, up 0.81% from mid-October.

Coal Indicators:

• The FOB Australia coking coal market saw a flat week, with current PMV offer at $365/mt for December laycan. The Chinese ports prime coal stocks were still low, while supply sources were tight in both seaborne and domestic market.