Verdict:

• Short-run Neutral.

Macro:

• US 10-Year-Bond yield reached 4.845%, the highest since July 2007.

• IMF report estimated Asia-Pacific growth rate reached 4.6% in 2023.

Iron Ore Key Indicators:

• Platts62 $118.35, -2.00, MTD $118.50. Seaborne iron ore saw stable trades during the week, most of which were fixed price trade. However, market participants were worried about the resilience of the demand in November market.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 18th)

• Futures 129,669,300 tons(Increase 957,800 tons)

• Options 116,465,600 tons(Increase 905,000 tons)

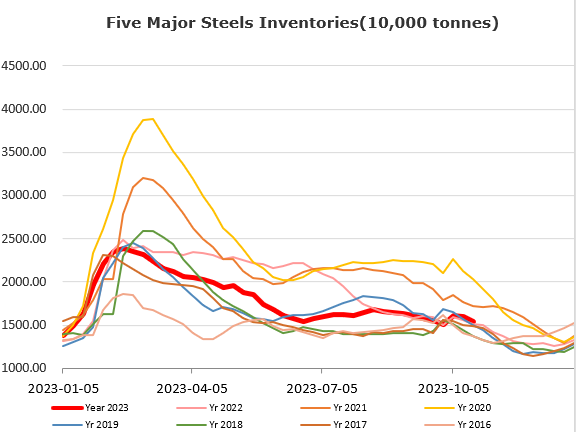

Steel Key Indicators:

• Tangshan average billet cost 3717 yuan/ton, up 18 yuan/ton on the week. Average production loss for long steel reached 287 yuan/ton.

• China NBS: China crude steel daily production reached 2.737 million tons, down 1.8%. Daily pig iron 2.3847 million tons, down 0.9% on the week.

Coal Indicators:

• The FOB Australia coking coal created the biggest drop in past three month by $21 at $340 for December laycan HCCA Branded cargo.

• China cokery plants proposal by 100-110 yuan/ton for the third rounds, yet to receive any response from steel mills.