Verdict:

• Short-run Neutral.

Macro:

• IMF Chief Kirstalina Georgieva indicated that the global economy growth slowed down to 3%. The growth rate would be dragged down by high interest rates.

Iron Ore Key Indicators:

• Platts62 $118.55, +3.00, MTD $118.19. PBF saw two trades based on December Index + $4.1 and $4.2 respectively, down from $5.2 last week.

• SGX Iron Ore 62% Futures& Options Open Interest (Oct 25th)

• Futures 137,653,400 tons(Increase 2,847,600 tons)

• Options 121,305,100 tons(Increase 1,077,500 tons)

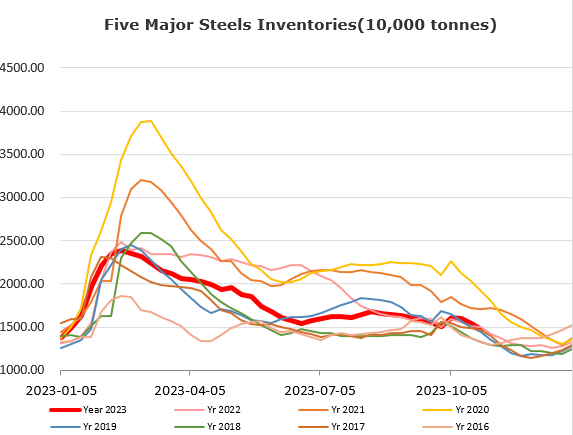

Steel Key Indicators:

• Tangshan average steel billet cost at 3714 yuan/ton, down 3 yuan/ton. Average loss at 364 yuan/ton, down 23 yuan/ton on the week.

• CISA statistics indicated that member steel mills daily crude steel production at 2.0391 million tons in mid-October, down 2.11% from early-October.

Coal Indicators:

• China 110 sample coke handling and washery plants operation at 74.1%, up 1.69% on the week.

• The Australia FOB market inched higher as December laycans were unable to fulfill the current demand. On the other side, the thin steel margin resisted China demand in size.