Verdict:

• Short-run Neutral.

Macro:

• US October non-agricultural payrolls increased by 150,000, which was lower than expected 180,000. The jobless rate raised to 3.9%, created the highest since January 2022.

• Saudi Arab Energy Ministration announced a production cut by 1 million barrals/day, extended to December 2023. The curb was effective from July 2023.

Iron Ore Key Indicators:

• Platts62 $126.80, +0.20, MTD $126.25. Seaborne market saw light trade during trading window, which likely indicated valuation of index became higher than acceptance. There was consistent India offers to China eyeing demand emergence during China winter.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 3rd)

• Futures 122,829,900 tons(Increase 2,499,700 tons)

• Options 98,068,300 tons(Increase 688,000 tons)

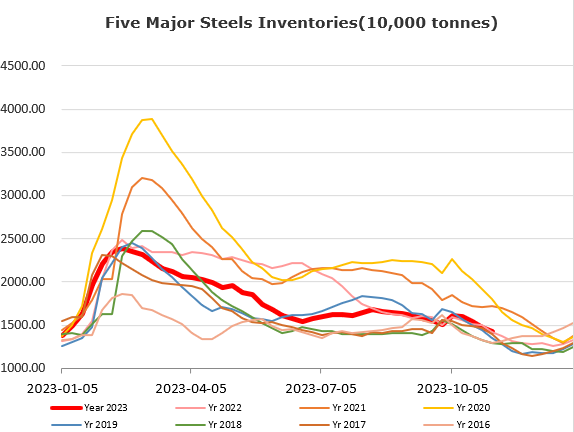

Steel Key Indicators:

• CISA: major steel enterprises crude steel production at 1.9238 million tons in late-October, down 5.65% from mid-October.

• MySteel 247 steel mills operation rate at 80.12%, down 2.37% on the week. Utilisation rate 90.23%, down 0.5% on the week.

Coal Indicators:

• The FOB Australia market index was stable seeing same level offer on $350/mt for HCCA Branded coal during past week.