Verdict:

• Short-run Neutral.

Macro:

• China Ministry of Commerce announced revisions to a list of bulk commodities requiring to keep statistical records, which include rare earth and iron ore. However market participants expect no direct impact on the process of imports or quota change.

• Australia Central Bank hiked interest rates by 25bps to 4.35%, refreshed new high since November 2011.

Iron Ore Key Indicators:

• Platts62 $126.10, -1.00, MTD $126.39. Seaborne market was quiet in early this week. JMBF saw float trade based on AM62% December Index + $0.2. MACF was traded at $126.5/mt, while the last trade was $117.85 in October 26th. The market indicated less interest on PBF because of the active and cost-efficient alternatives, in particular during a low steel margin time in China.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 7th)

• Futures 125,629,400 tons(Increase 1,701,600 tons)

• Options 102,210,300 tons(Increase 3,784,000 tons)

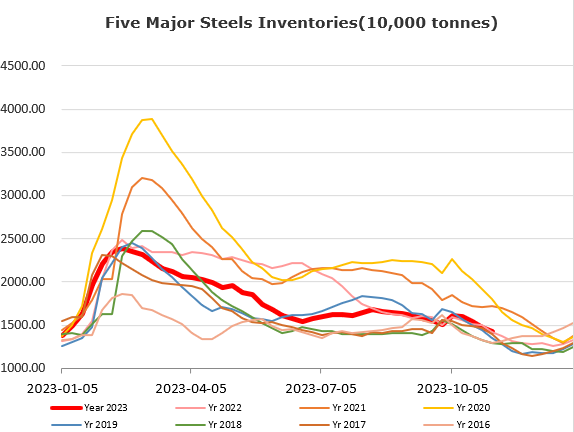

Steel Key Indicators:

• China total exported 7.939 million tons of steels, down 124,000 tons on the month. Jan- Oct total exported 74.73 million tons of steels, up 34.8% on the year.

Coal Indicators:

• The FOB Australia market index declined by $25 after the HCCA Branded coal offer saw no close bid for two weeks. The decreasing on secondary tier coals dragged down the market in general .