Verdict:

• Short-run Neutral to Bearish.

Macro:

• US jobless claims last week at 231,000, refreshed the highest since August 19th, est. 220,000, last 218,000.

Iron Ore Key Indicators:

• Platts62 $132.40, +0.40, MTD $128.38. Iron ore saw some BHP cargoes trade and low grade trade yesterday. MACF was traded at $130.9/mt. NHGF was traded at $132.5/mt.

• MySteel surveyed 45 iron ore ports inventories at 112.269 million tons, down 816,500 tons from last week. Daily evaluations at 3.0244 million tons, down 1,500 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 16th)

• Futures 132,730,100 tons(Increase 88,600 tons)

• Options 109,082,600 tons(Increase 757,000 tons)

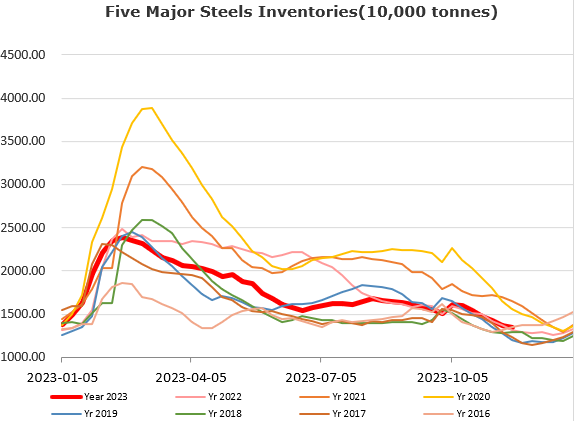

Steel Key Indicators:

• CISA: China major crude steel daily production at 1.97 million tons in early November, up 2.43% from mid-November, up 9.51% on the year.

• MySteel surveyed 247 steel mills utilisation rate at 79.67%, up 1.34% on the week, up 3.32% on the year. Daily pig iron production at 2.35 million tons, down 325,000 tons on the week, up 106,100 tons on the year.

Coal Indicators:

• After the fire accident in a miner area of Shanxi, China, the local government started safety check on the miners, which potentially impact production in the following weeks. The area increased 180 yuan/ton on the prime coking coals.