Verdict:

• Short-run Neutral.

Macro:

• Some of the key decision maker of ECB indicated to avoid premature interest rate cut, because of the high inflation and rather mild impact on economy.

• From November 19th to 23rd, there will be a regional heavy pollution weather process in Hebei, China. Environmental departments in Tangshan and other places in Hebei Province have issued notices to launch a Level II emergency response for heavily polluted weather on November 19th.

Iron Ore Key Indicators:

• Platts62 $129.75, -2.65, MTD $128.50. Iron ore saw some BHP cargoes trade and low grade trade yesterday. MACF was traded at $128/mt. PBF was traded based on December Index + $1.3, the last trade was at premium of $4.2 in early November. Hundreds of train drivers at BHP will kick off the first industrial action in decades as workers revolt against unpredictable treatment of working conditions. The strike expected to start from this Friday.

• MySteel surveyed 45 iron ore ports inventories at 112.269 million tons, down 816,500 tons from last week. Daily evaluations at 3.0244 million tons, down 1,500 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 17th)

• Futures 132,730,100 tons(Decrease 444,100 tons)

• Options 111,947,600 tons(Increase 2,865,000 tons)

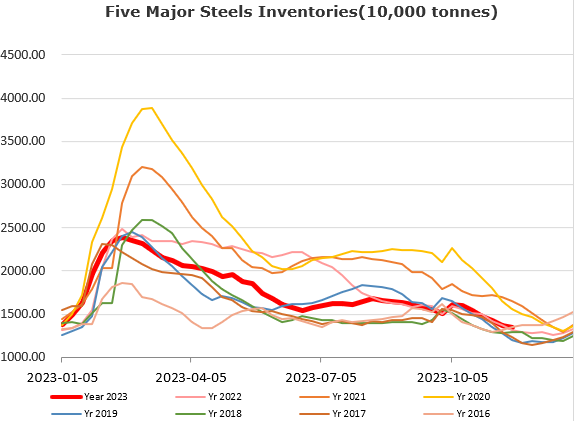

Steel Key Indicators:

• During past week, China steel mills iron ore imports at 90.54 million tons, up 475,300 tons on the week.

• MySteel estimated 247 blast utilisation rate at 79.67%, down 1.34% on the week, up 3.32% from the same period over last year.

Coal Indicators:

• The safety check in China coal miners as well as the restocking demand from Indian buyers back from holidays supported both CFR China and FOB Australia coking coal prices. There was PMV Goonyella traded at $326.77/mt for 40,000mt. However, the market participant saw an improvement on supply in Q1 2024.

• Most of the miners in Shanxi, China related to the last fire accidents finished safety check and restart operation on last Friday.