Verdict:

• Short-run Neutral to Bearish.

Macro:

• Fed Governor Waller seemed to “blown” about potential interest rate cuts, saying that if inflation continues to fall, there may be grounds for a rate cut in a few months, which was irrelevant to economic pressure.

Iron Ore Key Indicators:

• Platts62 $129.45, -4.00, MTD $130.37. The seaborne supply increased and pulled back the performance of iron ore price. The supply of seaborne is expected to maintain at slight high level compared to last year, and the weakened US dollar potentially shift demand from seaborne to portside in future weeks. The lump premium potentially maintain slight stable instead of fast pick up because the sintering constraint is not harsh as last winter.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 27th)

• Futures 142,717,300 tons(Increase 1,390,900 tons)

• Options 124,269,100 tons(Increase 875,000 tons)

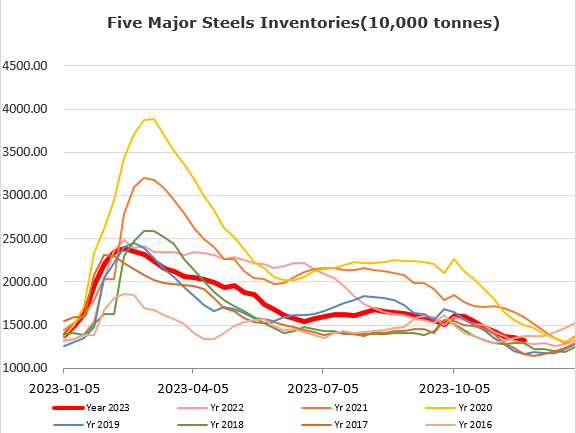

Steel Key Indicators

• The scrap imports if Vietnam maintained at 312,000 tons in October, rising marginally by 2.9% compared to September, and 3.1% higher than last year. Mills maintained utilisation at 40% eyeing sluggish demand on steels include housing sector.

Coal Indicators

• Hebei and Shangdong provinces mills in China accepted the second round of price increase proposed by cokery plants, total up 200-220 yuan/ton for the past two rounds.