Verdict:

• Short-run Neutral.

Macro:

• China imported 102.74 million tons of iron ore, up 3.36 million tons on the month, or 3.4%. The first 11 months in 2023 imported 1.078 trillion tons of iron ore, up 6.2% on the year.

• China imported 43.506 million tons of coals, up 7.514 million tons on the month, or 20.9% on the month. China total imported 4.27 trillion tons of coals for the first 11 months in 2023, up 62.8% on the year.

Iron Ore Key Indicators:

• Platts62 $136.05, +2.40, MTD $133.08. There was NHGF traded at $135.3/mt. The price uptick was more related to the fast decreasing US Treasury Yield, which supported valuation of high liquidity commodities and equities. However, China iron ore port stocks at 118.15 million tons, up 3.17 million tons, indicated the trend of stocks were on the rise. Pig iron consumption lowered for past 4 weeks. The marginal demand of iron ore is cooling down.

• Rio Tinto published 2024 guidance for Pilbara iron ore shipment from 323 – 338 million tons, in line with the prediction in October.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 7th)

• Futures 120,067,900 tons(Decrease 831,800 tons)

• Options 96,699,700 tons(Increase 1,993,900 tons)

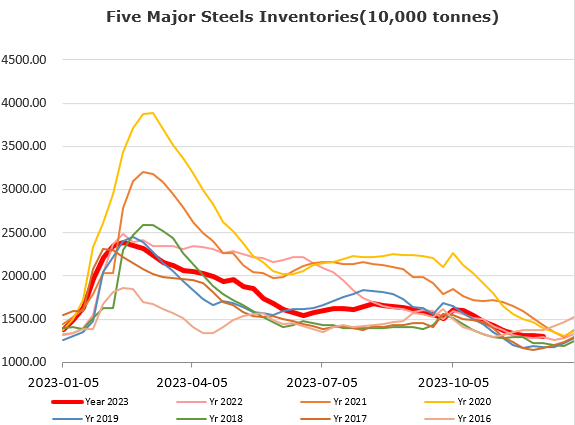

Steel Key Indicators:

• The 40 average EAFs average cost at 3953 yuan in China, average gain at 74 yuan/ton.

Coal Indicators:

• The 30 sample China cokery plants average production loss at 26 yuan/ton.