Verdict:

• Short-run Neutral.

Macro:

• Beijing and Shanghai are optimising real estate market policies. Beijing has decreased the down payment ratio to 30% for the first home puchase, and the 40% for the second home purchase. House loans cycle rise from 25 years to 30 years. The lower limit of the interest rate policy for new mortgage loans issued by commercial banks are expected to decrease in future months.

• The 10-year US Treasury yield broke 4% for the first time since August. US federal predicted a 75 bps cut to 4.6% in mid-2024. Dow Jones Index created historical high.

Iron Ore Key Indicators:

• Platts62 $135.25, -0.65, MTD $134.89. The seaborne trade was in general quiet in most of time in December compared to late November. Obviously the marginal demand has decreased. China mills were starting to hold conservative outlook for iron ore in the coming two months because of poor margin and sluggish demand market. The purchase was focus on low grade fines settled in CNY at ports.

• MySteel 45 ports iron ore inventories at 115.85 million tons, down 2.2978 million tons on the week. Daily evacuation 3.06 million tons, up 72,700 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 14th)

• Futures 121,552,700 tons(Increase 999,300 tons)

• Options 103,955,700 tons(Increase 521,000 tons)

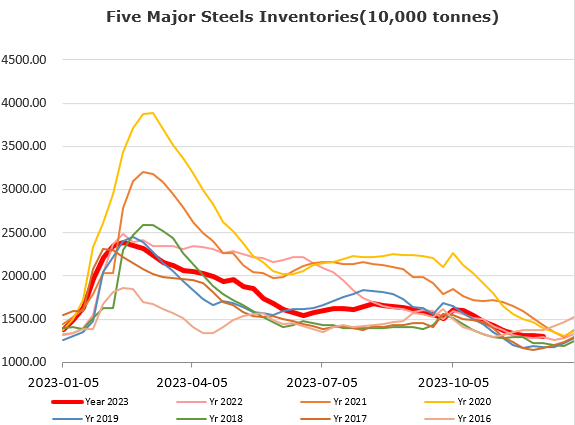

Steel Key Indicators:

• MySteel researched 247 steel mills utilisation rate at 78.31%, down 0.44% on the week, up 2.34% on the year. Daily pig iron production at 2.2686 million tons, down 24,400 tons on the week, up 39,800 tons on the year.

• China NBS: China produced 76.1 million tons of crude steels, up 0.4% on the year. China total produced 952.14 million tons of crude steel from January to November, up 1.5% on the year.

Coal Indicators:

• Snowy weather has blocked transportation in the main coal-producing areas of Shanxi, China. The snowfall will ease from the weekends according to weather bureau. Thus, traffic is expected to resume.