Verdict:

• Short-run Neutral.

Macro:

• China real estate developers rise after China injected $50 billion worth of low-cost funds into banks last month. Shanghai also announced lower down payment ratio for houses on Tuesday.

Iron Ore Key Indicators:

• Platts62 $143.20, +2.70, MTD $143.20. The liquidity injection news from China supported the iron ore growth in the current two days. FMG announced that the current derailment would not impact iron ore annual and quarter production and delivery guidance. NHGF traded at fixed price at $142.1. JMBF traded at February Index plus a discount at $2.8.

SGX Iron Ore 62% Futures& Options Open Interest (Jan 2nd)

• Futures 106,469,600 tons(Increase 995,400 tons)

• Options 78,258,400 tons(Increase 1,397,000 tons)

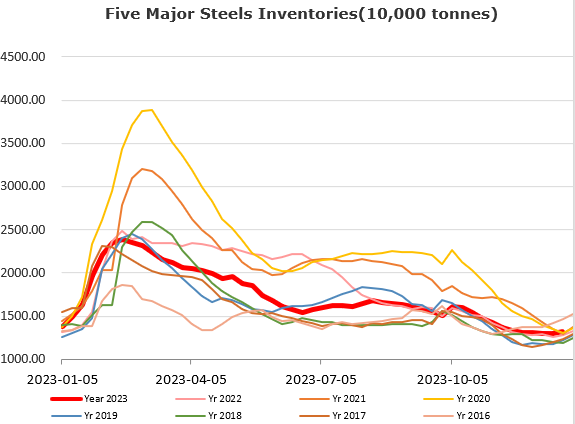

Steel Key Indicators:

• China sample EAFs average cost 4039 yuan/ton, up 14 yuan/ton on the week. Average profit 27 yuan/ton, down 17 yuan/ton on the week.

Coal Indicators:

• Hebei, China mills started to decrease physical coke price by 100- 110 yuan/ton, symbolised the start of price cut trajectory for physical coke.