Verdict:

• Short-run Bearish.

Macro:

• The United Nations released the “World Economic Situation and Prospects 2024”: Global economic growth is expected to slow down from 2.7% in 2023 to 2.4% in 2024. At the same time, the report predicts that global inflation will fall further, from 5.7% in 2023 to 3.9% in 2024.

• China December Caixin PMI reached 52.9, up 1.4 on the month, refreshed five-year high.

• US jobless files reached 202,000, est. 216,000, last 218,000.

Iron Ore Key Indicators:

• Platts62 $143.20, -0.75, MTD $143.45. The speculation on previous China PSL stimulus to support market monetary called an end, because traders need to see more details and how they land in further months. The current importers are waiting for lower January average on iron ore as index level. China restock demand should be resilient, but there were only three-four weeks before mills to take long break for Chinese New Year. MACF traded at $141.1, which fell out of 2-8 weeks assessment window. PBF was traded at $143.5.

• China 45 iron ore ports inventories at 122.45 million tons, up 2.53 million tons on the week. Daily evacuation at 3.05 million tons, up 71,400 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Jan 4th)

• Futures 109,118,000 tons(Increase 806,400 tons)

• Options 81,464,400 tons(Increase 1,386,000 tons)

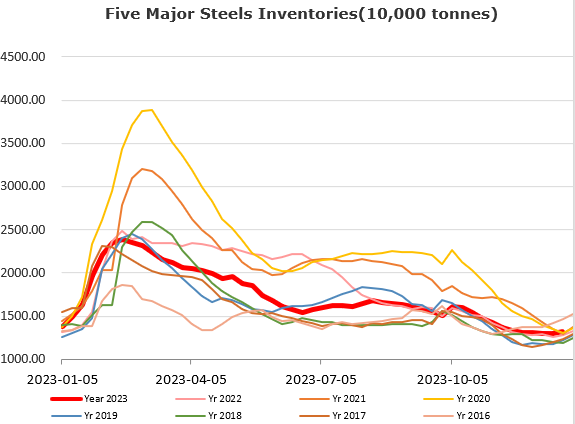

Steel Key Indicators:

• 40 sample EAFs in China average steel cost at 4062 yaun/ton, average profit at 20 yuan/ton.

Coal Indicators:

• Red Sea confliction increased shipment cost, however market participants were worried about the high material cost squeezed off the margins in Asian steel mills.

• The February laycans potentially became tight supplied given the rainy weather in Australia.