Verdict:

• Short-run Neutral.

Macro:

• The unexpected EIA report on the increasing oil inventories dragged down oil price by $1 overnight.

Iron Ore Key Indicators:

• Platts62 $139.10, -0.30, MTD $141.53. The prompt demand was weak given a decreasing pig iron production, when mills started maintenance. The demand for February laycans was resilient, considering restock after Chinese New Year. MB65- P62 potentially expand with the increasing demand on high grade versus mid grade. Vale sold IOCJ at $145.8/mt. BHP sold JMBF based on February Index and discount of $2.8.

SGX Iron Ore 62% Futures& Options Open Interest (Jan 10th)

• Futures 113,104,800 tons(Increase 657,400 tons)

• Options 93,481,500 tons(Increase 4,412,000 tons)

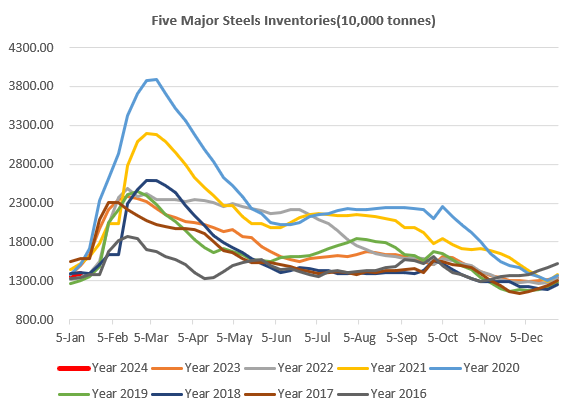

Steel Key Indicators:

• The biggest steel mill in China, Baowu Group maintain unchanged on the ex-factory price of HRC, CRC and galvanized sheet for February delivery during light season.

Coal Indicators:

• The second round of physical coke cut hit ground in China by 100- 110 yuan/ton. The total two rounds decreased by 200-220 yuan/ton.