Verdict:

• Short-run Bearish.

Macro:

• China Chief Economist Forum expected the infrastructure investment growth would reach 8%, CPI up 1.5% in 2024.

• The escalation of RedSea confliction forced more ships changed routes to avoid RedSea in long-run.

Iron Ore Key Indicators:

• Platts62 $131.20, -4.55, MTD $138.94. As the winter stock mostly completed, most of demand concentrated to spot cargoes. Thus, seaborne trade decreased significantly. Among the brands, mills preferred low grade fines after the widening of discounts. Buyers also prefer Brazil ores as the concerns on rainy weather. There was IOCJ sales at $143.4 during last Friday. The utilisation rate of Chinese mills entered a fast declining period.

• 45 China iron ore ports inventories at 126.21 million tons, up 3.76 million tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Jan 12th)

• Futures 114,968,300 tons(Increase 1,740,400 tons)

• Options 97,405,100 tons(Increase 2,029,300 tons)

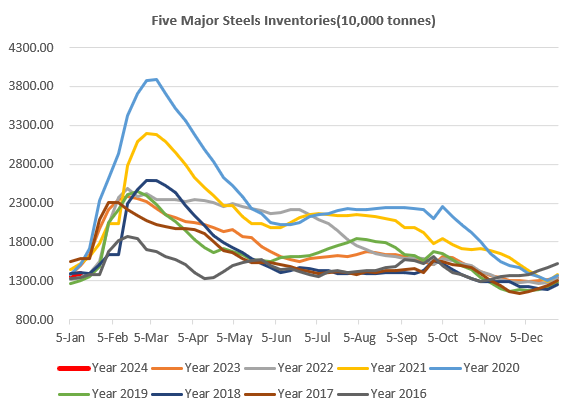

Steel Key Indicators:

• The operating rate of blast furnaces in 247 steel mills was 76.08%, a month on month increase of 0.45% and a year-on-year increase of 0.4%. The utilization rate of blast furnace reached 82.56%, with a month on month increase of 0.97% and unchanged year-on-year.

Coal Indicators:

• There was JSW bid at $310 for PMV at seller’s option, however yet to gain sellers interest. The market started to weigh the impact of fast decreasing demand because of incoming Chinese New Year.