Verdict:

• Short-run Neutral to Bearish.

Macro:

• US jobless claims reached 187,000, estimated 205,000, last 202,000.

• China Customs Statistics: China total exported 59.63 million tons of flat steels in 2023, up 40.6% on the year. China total exported 10.81 million tons of long steels, up 42.6%. China total imported 474.42 million tons of coals, up 61.8%.

Iron Ore Key Indicators:

• Platts62 $131.05, +3.40, MTD $135.97. Iron ore market followed the China equity movement during the last three trading days. However, iron ore marginally saw weak support as on the trend of decreasing pig iron production before Chinese New Year. As more steel mills announced the winter stocks discount and pricing. Spot steels expected to enter a quiet mode in coming weeks.

• MySteel estimated 45 iron ore port stocks at 126.42 million tons, up 207,900 tons on the month. Daily evacuation 3.19 million tons, up 64,000 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Jan 18th)

• Futures 117,460,000 tons(Increase 1,687,300 tons)

• Options 103,650,300 tons(Increase 1,092,500 tons)

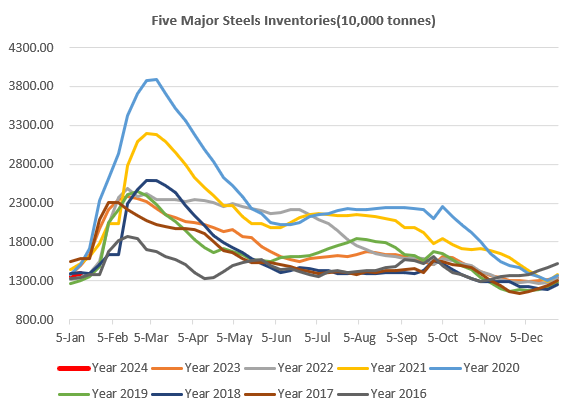

Steel Key Indicators:

• MySteel estimated 247 mills operation rate at 76.23%, up 0.15% on the week, up 0.26% on the year. Daily pig iron production at 2.2191 million tons, up 11,200 tons on the week, down 18,300 tons on the year.

Coal Indicators:

• The FOB Australia market inched down as the prompt demand became sluggish before Chinese New Year. Moreover, the difference of coking coal and coke became narrower, indicating a decreasing cokery margin. On the other side, wet weather and disruption in BHP miner will support on the bottom of current price.