Verdict:

• Short-run Neutral to Bearish.

Macro:

• US existing home sales decline to historical worst since 1995, contract closings decreased by 1% from a month earlier to a 3.78 million annualised rate.

• US January inflation rate reached 2.9%, refreshed the lowest since 2020.

Iron Ore Key Indicators:

• Platts62 $130.55, -0.50, MTD $135.58. Although there was a small recovery on pig iron consumption during past week, the demand was on the downward trend in general from December to February in China. Thus, iron ore buying became quiet both on ports and seaborne from mid-January. Half-finished and finished steels both became oversupplied in January, plus a weaker export at the same time. The current rebound was mostly contributed by the macro support on equity market and housing market. However, a priced-in on the news would normally bring back a correction.

SGX Iron Ore 62% Futures& Options Open Interest (Jan 19th)

• Futures 118,792,100 tons(Increase 1,332,100 tons)

• Options 104,491,000 tons(Increase 840,700 tons)

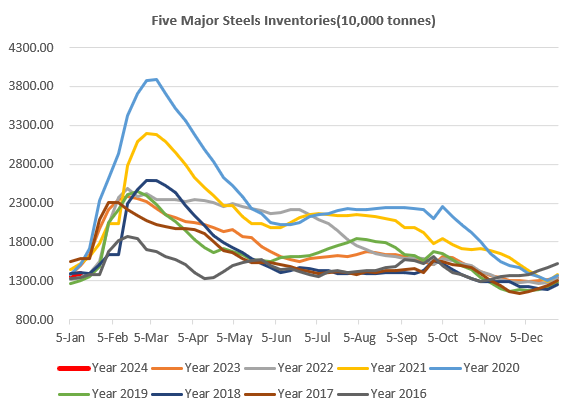

Steel Key Indicators:

• The current storm weather supported scrap price in US, however the weak demand offset the decrease of supply.

Coal Indicators:

• The NW Australia saw a new cyclone potentially landing from the coastal areas. Thus, buyers were waiting sidelines to avoid buying delayed laycans during the uncertain weather conditions.