Verdict:

• Short-run Neutral.

Macro:

• Maersk diverts ME2 service around the Cape of Good Hope because the situation around Redsea and the Gulf of Aden remained unstable.

Iron Ore Key Indicators:

• Platts62 $129.45, -1.10, MTD $135.17. There was no seaborne trade yesterday. Although there was a small recovery on pig iron consumption during past week, the demand was on the downward trend in general from December to February in China. Thus, iron ore buying became quiet both on ports and seaborne from mid-January. Half-finished and finished steels both became oversupplied in January, plus a weaker export at the same time. The current rebound was mostly contributed by the macro support on equity market and housing market. However, a priced-in on the news would normally bring back a correction.

• During the week from January 15-21st, Mysteel estimated Australia and Brazil iron ore shipments totaled 21.529 million tons, a month-on-month decrease of 1.340 million tons.

• China 45 ports iron ore total arrived 26.2 million tons, down 3.29 million tons on the week. Six northern ports iron ore total arrived 13.96 million tons, down 908,000 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Jan 22nd)

• Futures 119,649,000 tons(Increase 856,900 tons)

• Options 105,343,500 tons(Increase 852,500 tons)

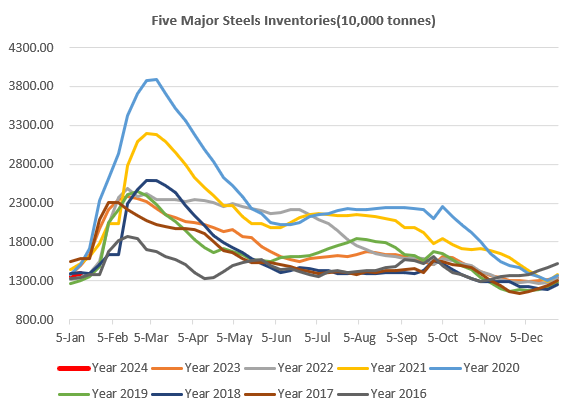

Steel Key Indicators:

• Russia steel production up 5.9% in 2023 at 75.8 million tons, approaching production level in 2021.

• Turkey HMS 80:20 ½ scrap price fell by $2.5/mt yesterday, market were split on the view of current price direction. The trade became slow.

Coal Indicators:

• The level III cyclone reported from BOM potentially land Queensland coast in January 25th, however traders believed that the price room were depending on the acceptance level from end-users currently.