Verdict:

• Short-run Neutral.

Macro:

• The Bank of Japan announced that it will maintain its current monetary policy unchanged and continue to adhere to the inflation control target of 2%. The Bank of Japan kept the short-term interest rate at negative 0.1% and kept the long-term interest rate at zero by purchasing long-term treasury bond.

Iron Ore Key Indicators:

• Platts62 $132.35, +2.90, MTD $134.99. NHGF traded at $130.8/mt, supply of Brazil cargo expected to become limited in Q1 . Although there was a small recovery on pig iron consumption during past week, the demand was on the downward trend in general from December to February in China. The current rebound was mostly contributed by the macro support on equity market and housing market. However, a priced-in on the news would normally bring back a correction. As the looming of Chinese New Year, the market potentially became less sensitive to the news and rumors.

SGX Iron Ore 62% Futures& Options Open Interest (Jan 23rd)

• Futures 120,812,300 tons(Increase1,163,300 tons)

• Options 106,440,900 tons(Increase 1,097,400 tons)

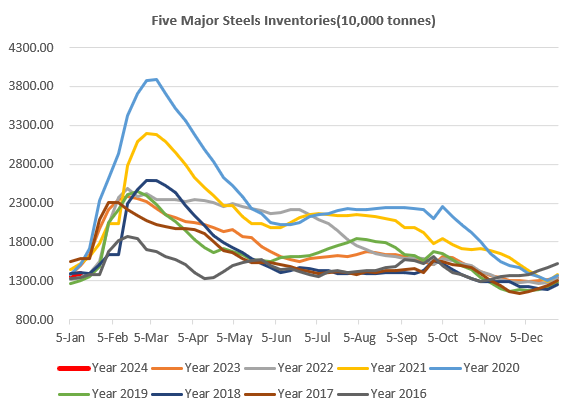

Steel Key Indicators:

• MySteel surveys indicated the steel production potentially reached seasonal low at 2 million tons/week during Chinese New Year.

Coal Indicators:

• The level III cyclone reported from BOM potentially land Queensland coast in January 25th, however traders believed that the price room were depending on the acceptance level from end-users currently.