Verdict:

• Short-run Neutral.

Macro:

• OECD published reports that the global crude steel production reached 2.499 billion tons in 2023, up 57.1 million tons on the year, or 2.3%, up 91.6 million tons from 2019.

• Eurozone January Manufacturing PMI reached 46.6, created 10-year-high, estimated 44.8, last 44.4.

Iron Ore Key Indicators:

• Platts62 $136.15, +3.80, MTD $135.06. Iron ore spiked following the news that China cut 50 bps RRR during yesterday afternoon. BHP sold two laycans of JMBF and MACF. Rio sold Two laycans of PBFs. The discount cargoes were still more popular than normal mid-grade fine given better cost-efficiency during the production cut cycle of China steel mills, plus a negative margin background. The room of rebound was believed limited as the pig iron was on the decreasing trend before Chinese New Year.

• BHP widened the discount for February cargo from 2.75% to 3.25%.

SGX Iron Ore 62% Futures& Options Open Interest (Jan 24th)

• Futures 122,199,000 tons(Increase 1,386,700 tons)

• Options 106,615,900 tons(Increase 175,000 tons)

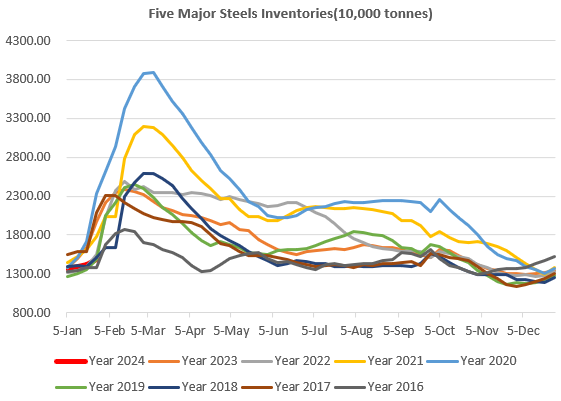

Steel Key Indicators:

• China Tangshan billet average cost at 3854 yuan/ton, down 15 yuan/ton on the week, the steel mills were suffering from a production loss by 234 yuan/ton.

Coal Indicators:

• There was report that Indian buyer purchased 30,000mt PMV Caval Ridge at $350/mt yesterday. Miners were reluctant to offer any cargo before seeing the impact of coming cyclone.