Verdict:

• Short-run Neutral to Bearish.

Macro:

• US jobless claim reached 224,000, refreshed new high since the week consecutive on November 11th in 2023, est. 212,000, last 214,000.

• BOE maintained unchanged interest rate at 5.25%, as expected from the market. The bankers indicated a interest rate cut would happen only if the Q2 inflation returned to 2% level.

Iron Ore Key Indicators:

• Platts62 $132.80, +1.00, MTD $132.80. Iron ore seaborne trade became quiet when China came into pre-holiday mode. Iron ore dropped as the recovery of marginal steel margin didn’t help comprehensive gaining of steel mills when the utilisation was approaching year-low level. In addition, the speculation of China interest rate cut and house buying ease was calling an end in short-run, the market was waiting for more details. The iron ore market was significantly oversupplied as the analysis in several previous reports as well as our weekly report.

• China 45 ports iron ore inventories at 108.24 million tons, up 3 million tons on the week, up 16.037 million tons on the year.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 1st)

• Futures 107,290,400 tons(Increase 1,267,400 tons)

• Options 87,703,000 tons(Increase 2,370,000 tons)

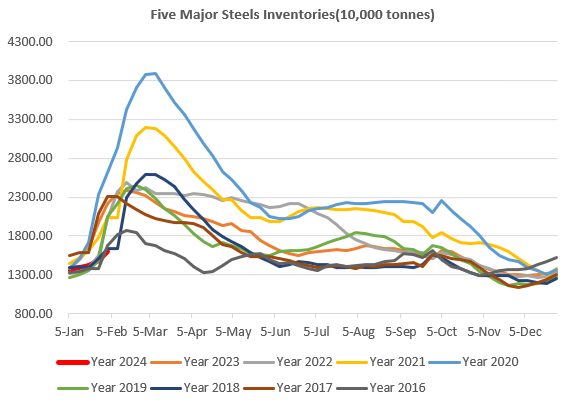

Steel Key Indicators:

• China 247 sample blast steel mills operation rate at 76.52%, down 0.3% on the week, down 0.89% on the year. Daily pig iron production at 2.2348 million tons, up 1,900 tons on the week, down 3.56% on the year.

Coal Indicators:

• The seaborne Australia FOB market corrected slightly by $1 to $323 yesterday after quite a few sources of offers emerged on market. Although the end users have high acceptance on the coking coals, China ceased restock and entered pre-holiday mode.