Verdict:

• Short-run Neutral.

Macro:

• The UN statistics indicated that thee ships passed by Suez Cannel down 42% during the past two months.

• The IMF estimated that the growth rate of China in 2024 expected to increase by 4.6%.

Iron Ore Key Indicators:

• Platts62 $128.00, -4.80, MTD $130.40. Iron ore market suffered correction following the correction of Chinese equity market as well as taking gains of a half-year length growth. Iron ore demand was weaker to supply, which last from late December to January. Physical traders became cautious on the buying activities to avoid long holiday arrivals.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 5th)

• Futures 107,267,200 tons(Decrease 23,200 tons)

• Options 88,561,500 tons(Increase 858,500 tons)

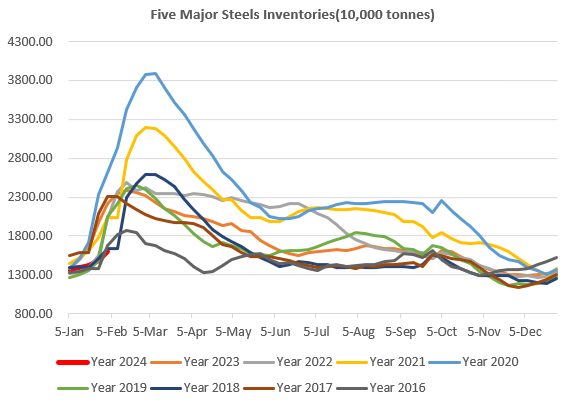

Steel Key Indicators:

• Turkey imported 9.58 million tons of iron ore in 2023, down 4%, however iron ore import from US tripled to 416,000 tons on the year.

Coal Indicators:

• The FOB coking coal market saw weaker market as the disagreement between sellers and buyers. The PLV down $1.5/mt per average day from last Friday.