Verdict:

• Short-run Neutral to Bearish.

Macro:

• BOE central banker Andrew Baily indicated the policymakers potentially support interest cut even without reaching the 2% inflation rate target.

Iron Ore Key Indicators:

• Platts62 $121.95, -6.85, MTD $128.25. Iron ore saw a stable supply in Q1 from both Brazil and Australia, seeing all potential logistic disruption recovered in February. In addition, the higher stocks in both mills and port added to the pressure on current price. Sales of raw materials became slow because of the marginal loss on steel making from blast furnaces. Traders tend to believe the correction was due to a risk-in after speculation of iron ore based on supply disruption and housing stimulus. However, news became quiet normally before China Politburo in March.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 20th)

• Futures 114,391,600 tons(Increase 3,066,200 tons)

• Options 97,495,700 tons(Increase 1,476,600 tons)

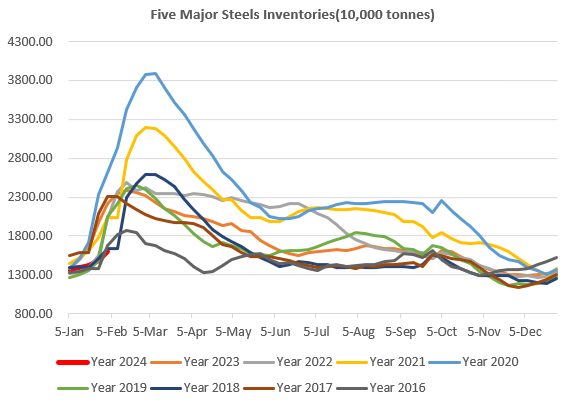

Steel Key Indicators:

• China Zenith Steel ex-work Rebar price up 50 yuan at 4150 yuan/ton, wire rods up 50 yuan at 4400 yuan/ton.

Coal Indicators:

• The FOB market sentiment weakened after Chinese New Year and dropped following the weakened China onshore coking coals and cokes. Unexpectedly, both China and India buyers were slowing down the restocking pace. In addition, the bids were generally soft during February.