Verdict:

• Short-run Neutral to Bearish.

Macro:

• US jobless claims at 201,000, est. 216,000, last 212,000.

• US Federal Reserve Patrick Harker stated that there should be no urgency to cut interest rates. The Fed’s focus is on the job market and economic data for the coming months, which will determine when the cut happens.

Iron Ore Key Indicators:

• Platts62 $120.60, +0.60, MTD $127.19. The impact of cyclone Lincoln expected to be minimized as the level of cyclone decreased and entered inland. Thus, port areas expected to recover to normal operation during weekends. Brazil miners claimed no impact on the flood and heavy rain during past few days. The 45 China ports iron ore inventories at 136.03 million tons, up 4.55 million tons on the week. Daily evacuation 2.6955 million tons, down 338,300 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 22nd)

• Futures 118,046,200 tons(Increase 1,943,400 tons)

• Options 116,555,300 tons(Increase 5,703,000 tons)

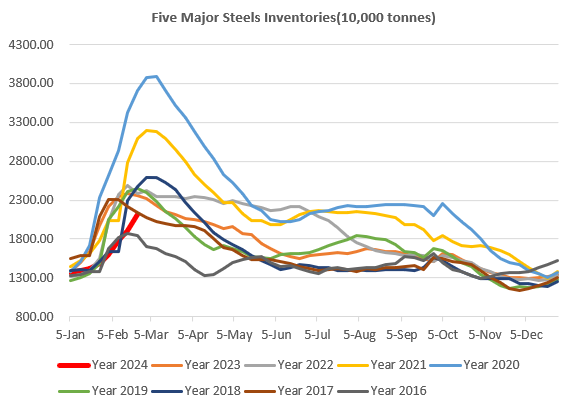

Steel Key Indicators:

• MySteel researched 247 blast furnace utilisation rate at 75.63%, down 0.74% on the week, down 5.35% on the year. Blast utilisation rate 83.59%, down 0.38% on the week, down 3.38% on the year.

Coal Indicators:

• The surveyed 30 Chinese cokery plants operated at 107 yuan/ton of production loss. There was 113 yuan of cokery loss on Shanxi Prime Coal.

• The FOB coking coal market saw 40,000mt PLV trade at $314/mt, which fell within the $314-315/mt range of previous offers in the week. However the bid on globalCOAL on PLV dropped from $300/mt to $290/mt.