Verdict:

• Short-run Neutral.

Macro:

• China Government Report set target in 2024: GDP growth target 5%, 12 million new urban jobs, unemployment rate 5.5%, consumer price increase of about 3%, grain output 6500 billion tons, energy consumption per unit reduced by 2.5%, and improve the quality of the ecological environment.

• China government work report indicated the GDP growth target for 2024 at 5%, unchanged from 2023.

Iron Ore Key Indicators:

• Platts62 $117.25, -0.50, MTD $116.80. Iron ore market saw signals of stablisation after a 20% correction in February. There were consistent seaborne trade on PBF and NHGF, as the recovery on their cost-efficiency. The market was waiting for more discount or lower price levels for low grade fines. Vale sold 170kt BRBF at MOC at $118.2/mt.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 5th)

• Futures 97,110,600 tons(Increase 307,400 tons)

• Options 106,740,100 tons(Increase 850,500 tons)

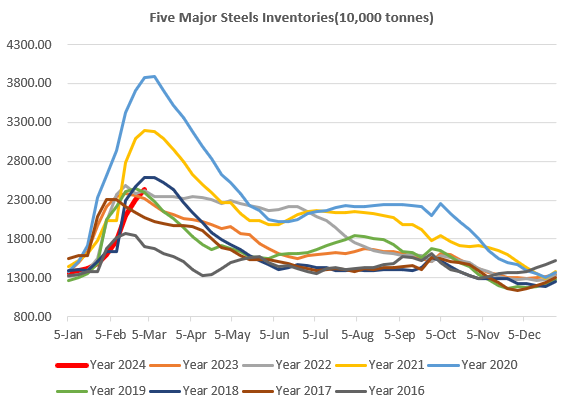

Steel Key Indicators:

• According to data from the China Steel Association, the daily crude steel production of member steel enterprises was 2.13 million tons in late February, a month on month increase of 1.38%, and a decrease of 4.06% year-on-year.

Coal Indicators:

• There was a $307/mt bid for the previous PLVs offers during past week and early of this week. However market expect lower bid considering several unsold laycans. The buyers would start to think about index-linked rather than fixed trade, expecting a weaker market sentiment.