Verdict:

• Short-run Neutral.

Macro:

• The US February non-agricultural payrolls up 275,000, however the labor market potentially hide the softening, given a 3.9% increase on jobless rate.

• China NBS announced that the February CPI up 0.7%, higher than 0.3% estimated by Reuters. The fast growth ended the four consecutive decrease and created the fastest growth since March 2023.

Iron Ore Key Indicators:

• Platts62 $116.65, -2.35, MTD $117.29. The elevated port inventories indicated a slow down on recovery of pig iron production. However, the steels export expected to rise in Q1. BHP sold 90,000mt NHGF at $115.6/mt.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 8th)

• Futures 101,093,500 tons(Increase 1,149,800 tons)

• Options 109,213,600 tons(Increase 925,500 tons)

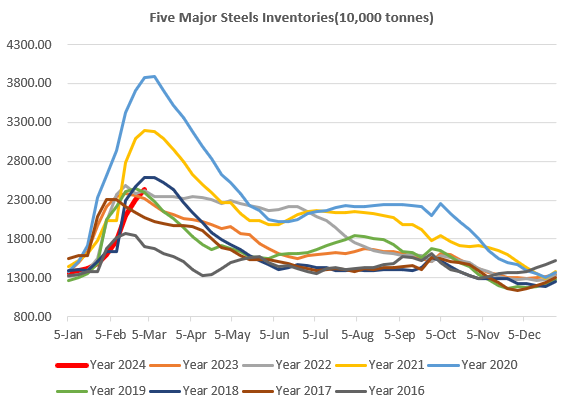

Steel Key Indicators:

• CISA data indicated that the late February fell by 1.5% from mid-February to 2.074 million mt.

Coal Indicators:

• The FOB Australia coking coal lowered again to $305 from $307 on PLVs, which dragged down the index level. The oversupply on front month laycans potentially resisted the current price level.