Verdict:

• Short-run Neutral.

Macro:

• China National Statistics Bureau: China industrial value added amount above designated size up by 7% in January and February, up 0.2% from last December.

• A statistic from BOE indicated that the expected inflation rate during the past three month had dropped from 3.3% to 3.0%. The long-run expected inflation rate dropped from 3.2% to 3.1%.

Iron Ore Key Indicators:

• Platts62 $100.20, -4.15, MTD $112.20. Seaborne iron ore index dropped to 10-year-low, as the climbing of iron ore deliveries and arrivals to China ports. Traders started to destock. Mills controlled overall cost and also try to control inventories levels. There were some signs of stablisation on futures market, however the major sentiment of physical market was cashing for liquidities.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 15th)

• Futures 112,479,500 tons(Increase 2,931,400 tons)

• Options 126,045,600 tons(Decrease 210,000 tons)

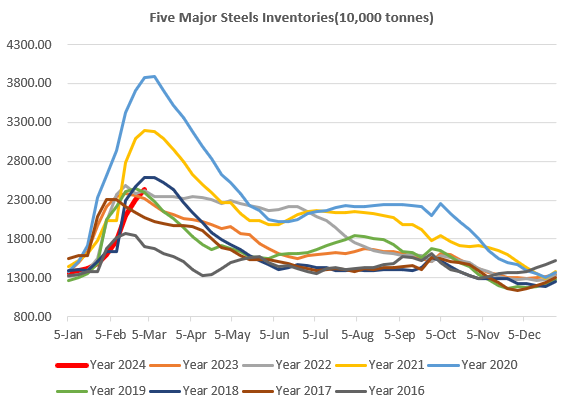

Steel Key Indicators:

• The 247 steel mills operation rate 76.15%, up 0.55% on the week, down 6.14% on the year.

• China 87 sample EAFs operation rate at 68.82%, up 5.63% on the week, down 9.44% on the year.

Coal Indicators:

• The FOB Australia coking coal corrected further. The buyers were only interested in index level coking coals, since the oversupply on nearby laycans. However the market saw a slow down on the correction in general from late last week.