Verdict:

• Short-run Neutral to Bullish.

Macro:

• From January to February, China’s pig iron production reached 140.73 million tons, a year-on-year decrease of 0.6%. The crude steel production was 167.96 million tons, a year-on-year increase of 1.6%; The steel production was 21.343 million tons, a year-on-year increase of 7.9%. China’s coal production above designated size reached 710 million tons, a year-on-year decrease of 4.2%, and an increase of 1.9% in December of the previous year.. Imported coal reached 74.52 million tons, a year-on-year increase of 22.9%, continuing to maintain rapid growth.

• From January to February, China’s real estate development investment was 1184.2 billion yuan, a year-on-year decrease of 9.0%. The sales area of newly-built commercial housing was 113.69 million square meters, a year-on-year decrease of 20.5%.

Iron Ore Key Indicators:

• Platts62 105.25, +5.05, MTD 111.62. Platts report indicated that 53 ports discharged 30 million tons in the week consecutive March 11th, up 5 million tons on the week. There are more signals indicating an oversold on the market with more enquiries. However the trade was light. Corex traded 90kt Fe60.8% MACF at $101.9. Some traders believed an oversold sentiment as the margin improved.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 18th)

• Futures 113,989,300 tons(Increase 1,509,800 tons)

• Options 128,901,100 tons(Increase 2,855,500 tons)

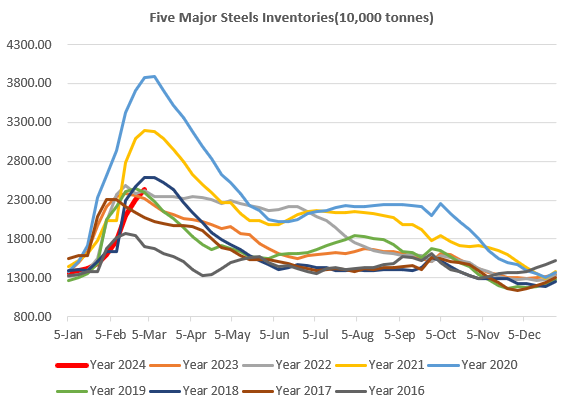

Steel Key Indicators:

• The Vietnam Dong depreciated significantly versus US dollar, which increased the import cost in steel products. Moreover the increasing freight cost added to the import cost. Local manufacturers preferred to work with domestic steel mills. HRCSS400 dropped by $15 in south-east Asia.

Coal Indicators:

• The FOB Australia coking coal corrected further. The buyers were only interested in index level coking coals, since the oversupply on nearby laycans. However the market saw a slow down on the correction in general from late last week.