Verdict:

• Short-run Neutral to Bullish.

Macro:

• Bank of Japan announced an interest rise by 10bps to 0% – 0.1%. The eight-year length negative interest rate officially terminated.

Iron Ore Key Indicators:

• Platts62 $107.90, +2.65, MTD $111.33. The fast recovery on derivatives market as well as the return of China demand boosted the price of iron ore in early half of the week. The physical market became more active compared to past three weeks. There were fixed MACF traded at $106.85, because the cost-efficiency of MACF remained high over other mid-grade concentrates. JMBF was traded on Platts62% April index and a discount of $4.2.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 19th)

• Futures 114,160,000 tons(Increase 170,700 tons)

• Options 130,401,100 tons(Increase 1,500,000 tons)

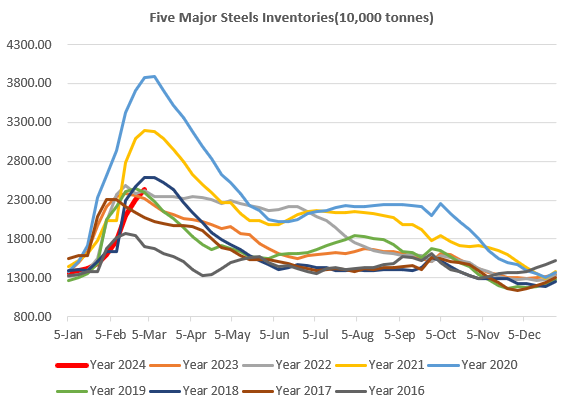

Steel Key Indicators:

• CISA statistic indicated that the crude steel output in February reached 66.30 million tons among its members, up 0.71% on the year. Pig iron production over the period reached 59.27 million tons, up 2.4% on the year.

Coal Indicators:

• China Hebei, Tianjin steel mills started to propose the sixth round of price cut by 100-110 yuan/ton, waiting for responses from cokery plants.