Verdict:

• Short-run Neutral.

Macro:

• US White House announced plans to implement new restrictions on Chinese steel and aluminum products, including raising the 301 tariff on Chinese steel and aluminum products to three times the current level.

• US jobless claims last week reached 212,000, est. 215,000, last 211,000.

Iron Ore Key Indicators:

• Platts62 $117.80, +1.20, MTD $107.02. China 45 iron ore port inventories at 145.59 million tons, up 720,000 tons on the week, up 15.24 million tons on the year. Daily evacuation at 3 million tons, down 13,500 tons on the week. There were seaborne SSF traded yesterday. In addition, NHGF and JMBF were traded. The physical market demand was robust in April.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 18th)

• Futures 117,669,900 tons(Increase 624,200 tons)

• Options 133,983,400 tons(Increase 1,910,000 tons)

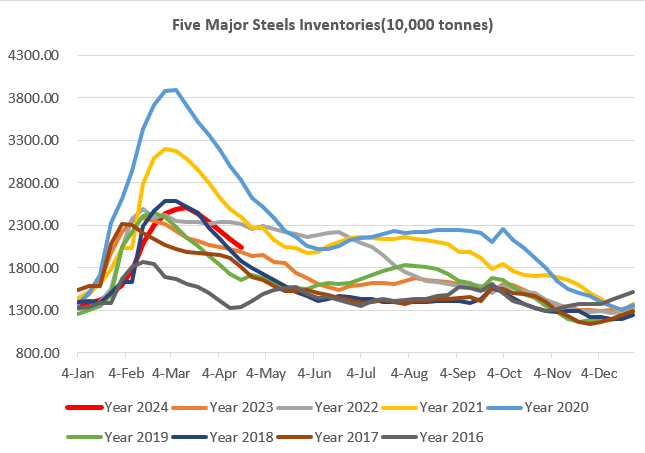

Steel Key Indicators:

• China major steel mills inventories at 93.65 million tons, up 447,600 tons on the week, up 2.41 million tons on the year. Daily consumption at 2.77 million tons, up 8,900 tons on the week, down 215,700 tons on the year.

Coal Indicators:

• In March 2024, China imported 41.38 million tons of coals, a year-on-year increase of 0.5%. From January to March, the cumulative import volume was 115.9 million tons, a year-on-year increase of 13.9%.