Verdict:

• Short-run Neutral.

Macro:

• According to data released by the US Department of Commerce, the US real gross domestic product (GDP) grew at an annual rate of 1.6% in the first quarter of this year, which is significantly narrower than the 3.4% growth rate in the fourth quarter of last year, est. 2.4%.

Iron Ore Key Indicators:

• Platts62 $118.90, +0.05, MTD $109.84. The iron ore rebounded following metals hike. Physical market saw massive trades in current two days. There were MACF and JMBF trades today, since BHP widened discounts. Steel mills expected to enter marginal loss condition in next 2 weeks with high iron ore price and fast pick up on physical coke. Virtual steel margin already reached negative area.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 25th)

• Futures 122,695,100 tons(Increase 1,981,900 tons)

• Options 155,164,800 tons(Increase 9,626,900 tons)

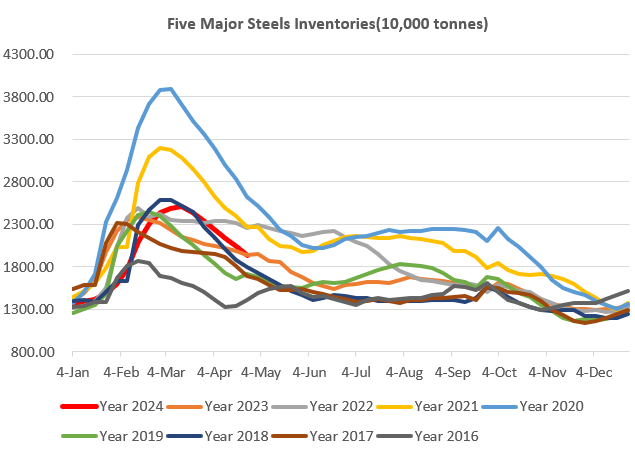

Steel Key Indicators:

• China steel mills average daily pig iron production at 2.2872 million tons, up 25,000 tons on the week, down 148,200 tons on the year.

Coal Indicators:

• China cokery plants were initiating for the third round of price hike by 100-110 yuan/ton.

• An Indian end-user bought 40,000mt PMV at $249/mt yesterday.