Verdict:

• Short-run Neutral.

Macro:

• China Daily: Xi says there is no such thing as “China overcapacity” in a China-France-EU trilateral meeting with French President Emmanuel Macron and European Commission President Ursula von der Leyen, and urged to increase cooperation in green and data transition and decrease trade barriers.

• US Federal Williams indicated that there will be interest cut, however decisions are based on totality of statistics, which largely were positive for H1.

Iron Ore Key Indicators:

•Platts62% $120.2, +$3.15, MTD $118.13. China ports saw active trade post holiday. MACF and BRBF saw fixed trades on seaborne market. The sales of steel warmed significantly. However the steel margin was in seasonal low area, the sustainability of the growth became a question.

• Australia and Brazil total delivered 26.87 million tons of iron ore last week, up 897,000 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (May 6th)

• Futures 106,245,100 tons(Increase 2,302,500 tons)

• Options 128,285,700 tons(Increase 121,000 tons)

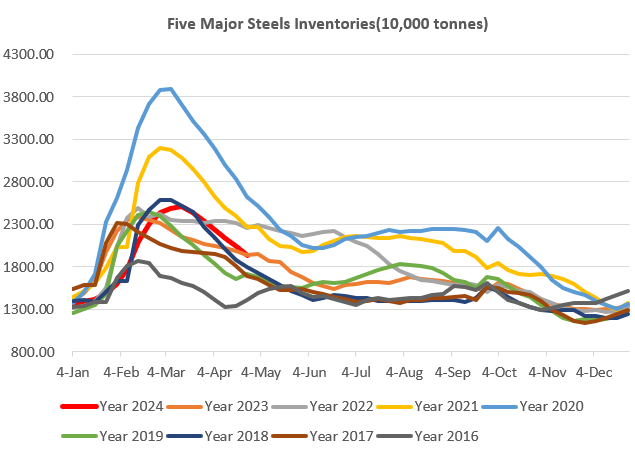

Steel Key Indicators:

• The 87 China EAFs average utilisation rate at 51.1%, up 0.61% on the week, up 0.67% on the year.

• Following the significant growth on raw materials and China offers, Vietnam steel mills Hoa Phat increased HRC SS400/SAE1006 by $25 to $575 CIF Ho Chi Minh for the first time since this February.

Coal Indicators:

• China major cokery plants proposed the fourth rounds of price hike by 100-110 yuan/ton.