Verdict:

• Short-run Neutral to Bearish.

Macro:

• The European stock market hit a record high, with strong performance from UBS and UniCredit, boosting optimism about interest rate cuts. The STOXX 600 index rose 1.1%, marking its best daily performance in over three months. The Spanish stock index rose 1.5%. The French stock CAC-40 index closed up 0.99%. The German DAX index closed up 1.4%. The FTSE 100 index in the UK closed up 1.22%, setting a new record high.

• The second round of China ecological protection inspections have been fully launched, covering 7 provinces (cities) including Shanghai, Zhejiang, Jiangxi, Hubei, Hunan, Chongqing, and Yunnan, lasting for a month time.

Iron Ore Key Indicators:

• Platts62 $118.75, -1.45, MTD $118.29. The MB65-P62 spread recovered from $12.56 as April average to $15.12 as May average so far. We mentioned this trend in weekly reports from end February. The spread believed to widen further as the tight supply in high grade and crowded condition in mid-grade. In addition, steel production expected to improve in May.

SGX Iron Ore 62% Futures& Options Open Interest (May 7th)

• Futures 106,654,600 tons(Increase 409,500 tons)

• Options 128,958,200 tons(Increase 672,500 tons)

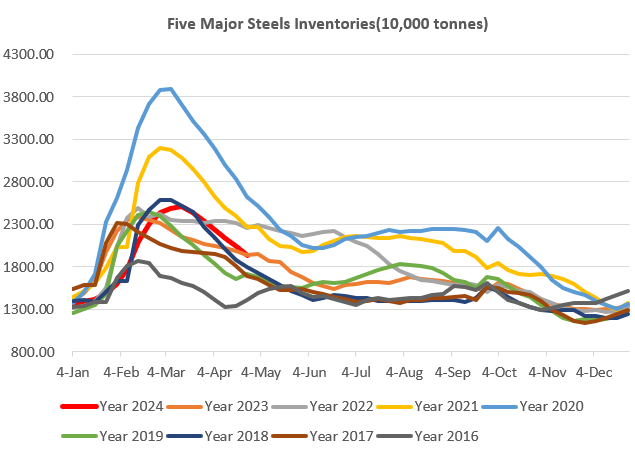

Steel Key Indicators:

• North Europe HRC down €5/ton to €630/ton this week, however north-west Europe and south Europe both see signals of market bottoms as increasing orders in May and June. The competitive sources from international market decreased as the appreciation of dollar versus Euros.

Coal Indicators:

• China major cokery plants proposed the fifth rounds of price hike by 100-110 yuan/ton.