Verdict:

• Short-run Neutral to Bearish.

Macro:

• Anglo American rejected second offer of $42.7 billion from BHP, saying the undervalue of the company.

Iron Ore Key Indicators:

• Platts62 $117.25, +0.65, MTD $117.33. There was lack of concentrates trade yesterday, given a derailment news from Rio Tinto. China total iron ore arrivals at 45 ports reached 21.46 million tons, down 2.345 million tons on the week. The delivery of Australia and Brazil reached 24.46 million tons, down 2.42 million tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (May 13th)

• Futures 112,226,600 tons(Increase 2,401,000 tons)

• Options 136,352,700 tons(Increase 2,600,000 tons)

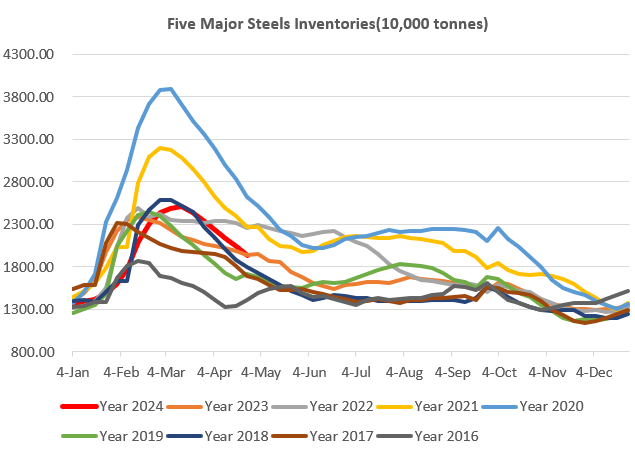

Steel Key Indicators:

• According to AISI, US steel utilisation rate recovered from 76.6% to 77% last week, down 2.9% on the year. As of May 4th, US total produced 30.26 million tons of steel in 2024, average utilisation rate at 76.3%.

• MySteel estimated 40 China EAFs average cost at 3837 yuan/ton, average production loss at 94 yuan/ton.

Coal Indicators:

• The supply of June cargoes expected to increase for PMVs and PLVs. The bid-offer spread maintained wide at $28.